solution

solution.

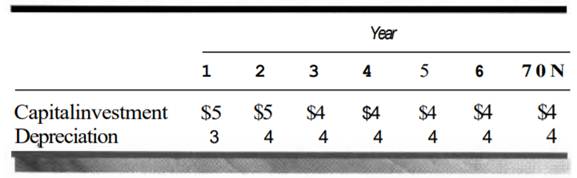

The R.Z. Frank Company may acquire Azii Car Leasing Company. Frank estimates that Aziz will provide incremental net income after taxes of $2 million in the first year, $3 million the second, $4 million the third, $5 million in each of the years 4 through 6, and $6 million annually thereafter. Wig to the need to replenish the fleet, heavier than usual investments are required in the first 2 years. Capital investments and depreciation charges are expected to be (in millions):

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You wonât have to worry about the quality and deadlines

Order Paper NowThe overall required rate of return is 15 percent. Compute the present value of the acquisition based on these expectations. If you had a range of possible outcomes, how would you obtain the information necessary to analyze the acquisition?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"