solution

solution.

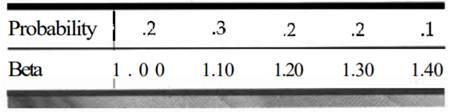

Acosta Sugar Company has estimated that the overall return for Standard & Poor's 500-Stock Index wiU be 15 percent over the next 10 years. The company also feels that the interest rate on Treasury securities will average 10 percent over this interval. The company is thinking of expanding into a new product line: almonds. It has had no experience in this line but has been able to obtain information on various companies involved in producing and processing nuts. Although no company examined produces only almonds, Acosta's management feels that the beta for such a company would be 1.10 once the almond operation was ongoing. There is some uncertainty about the beta that will actually prevail. Management has attached the following probabilities to possible outcomes:

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You wonât have to worry about the quality and deadlines

Order Paper Nowa. What is the required rate of return for the project using the mode beta of 1.10?

b. What is the range of required rates of return?

c. What is the expected value of required rate of return?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"