solution

solution.

Analyzing and Interpreting Intercorporate Investments

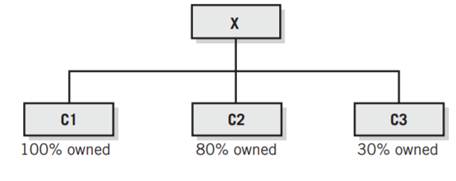

The diagram below portrays Company X (the parent or investor company), its two subsidiaries C1 and C2, and its “50 percent or less owned” affiliate C3. Each of the companies has only one type of stock outstanding, and there are no other significant shareholders in either C2 or C3. All four companies engage in commercial and industrial activities.

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Now

Required:

a. Explain whether or not each of the separate companies maintains distinct accounting records.

b. Identify the type of financial statements each company prepares for financial reporting.

c. Assume you have the ability to enforce your requests of management, describe the type of financial statement information about these companies (separate or consolidated) that you would request.

d. Explain what Company X reports among its assets regarding subsidiary C1.

e. In the consolidated balance sheet, explain how the 20 percent of C2 that is not owned by Company X is reported.

f. Identify the transaction that is necessary before C3 is included line by line in the consolidated financial statements.

g. If combined statements are reported for C1 and C2, discuss the need for any elimination entries.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"