solution

solution.

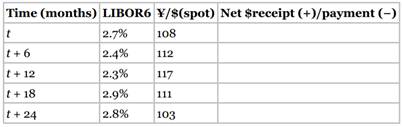

At time t, 3M borrows Ă‚ÂĄ10.8 billion at an interest rate of 0.2%, paid semiannually, for a period of two years. It then enters into a two-year yen/dollar swap with Bank of America (BofA) on a notional principal amount of $100 million (Ă‚ÂĄ10.8 billion at the current spot rate). Every six months, 3M pays BofA U.S. dollar LIBOR6, while BofA makes payments to 3M of 0.3% annually in yen. At maturity, BofA and 3M reverse the notional principals. Assume that LIBOR6 (annualized) and the Ă‚ÂĄ/$exchange rate evolve as follows.

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Nowa. Calculate the net dollar amount that 3M pays to BofA (“−”) or receives from BofA (“+”) in each six-month period.

b. What is the all-in dollar cost of 3M’s loan?

c. Suppose 3M decides at t + 18 to use a six-month forward contract to hedge the t + 24 receipt of yen from BofA. Six-month interest rates (annualized) at t + 18 are 2.9% in dollars and 1.1% in yen. With this hedge in place, what fixed dollar amount would 3M have paid (received) at time t + 24? How does this amount compare to the t + 24 net payment computed in Part a?

d. Does it make sense for 3M to hedge its receipt of yen from BofA? Explain.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"