dolution

dolution.

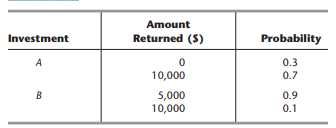

Imagine that you have $5,000 to invest and that you will have an opportunity to invest that amount in either of two investments (A or B) at the beginning of each of the next 3 years. Both investments have uncertain returns. For investment A you will either lose your money entirely or (with higher probability) get back $10,000 (a profit of $5,000) at the end of the year. For investment B you will get back either just your $5,000 or (with low probability) $10,000 at the end of the year. The probabilities for these events are as follows:

Ă‚Â

Ă‚Â

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Now

You are allowed to make only (at most) one investment each year, and you can invest only $5,000 each time. (Any additional money accumulated is left idle.)

(a) Use dynamic programming to find the investment policy that maximizes the expected amount of money you will have after 3 years.

Ă‚Â (b) Use dynamic programming to find the investment policy that maximizes the probability that you will have at least $10,000 after 3 years.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"