solution

solution.

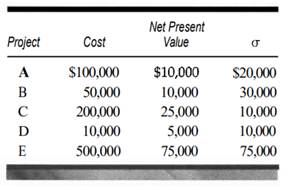

The Hume Corporation is faced with several possible investment projects. For each, the total cash outflow required will occur in the initial period. The cash outflows, expected net present values, and standard deviations are as follows. (All projects have been discounted at a risk-free rate of 8 percent, and it is assumed that the distributions of their possible net present values are normal.).

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You wonât have to worry about the quality and deadlines

Order Paper Nowa. Determine the coefficient of variation for each of these projects. (Use cost plus net present value in the denominator of the coefficient.)

b. Ignoring size, do you find some projects clearly dominated by others?

c. May size be ignored?

d. What is the probability that each of the projects will have a net present value greater than O?

e. What decision rule would you suggest for adoption of projects within this context? Which (if any) of the foregoing projects would be adopted under your rule?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"