solution

solution.

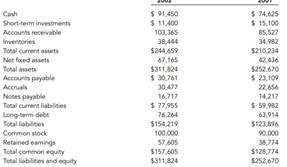

Start with the partial model in the file Ch 09 P13 Build a Model.xls from the textbook’s web site. Cumberland Industries’ 2001 and 2002 balance sheets (in thousands of dollars) are shown below and in the partial model in the file:

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Nowa. The company’s sales for 2002 were $455,150,000, and EBITDA was 15 percent of sales. Furthermore, depreciation amounted to 11 percent of net fixed assets, interest charges were $8,575,000, the state-plus-federal corporate tax rate was 40 percent, and Cumberland pays 40 percent of its net income out in dividends. Given this information, construct Cumberland’s 2002 income statement. (Hint: Start with the partial model in the file.)

b. Next, construct the firm’s statement of retained earnings for the year ending December 31, 2002, and then its 2002 statement of cash flows.

c. Calculate net operating working capital, total operating capital, net operating profit after taxes, and free cash flow for 2002.

d. Calculate the firm’s EVA and MVA for 2002. Assume that Cumberland had 10 million shares outstanding, that the year-end closing stock price was $17.25 per share, and its after-tax cost of capital was 12 percent.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"