solution

solution.

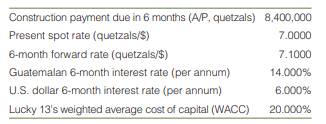

Lucky 13. Lucky 13 Jeans of San Antonio, Texas, is completing a new assembly plant near Guatemala City. A final construction payment of Q8,400,000 is due in six months. (“Q” is the symbol for Guatemalan quetzals.) Lucky 13 uses 20% per annum as its weighted average cost of capital. Today’s foreign exchange and interest rate quotations are as follows:

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

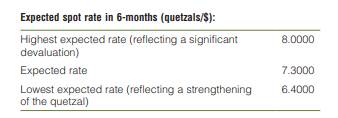

Order Paper NowLucky 13’s treasury manager, concerned about the Guatemalan economy, wonders if Lucky 13 should be hedging its foreign exchange risk. The manager’s own forecast is as follows:

What realistic alternatives are available to Lucky 13 for making payments? Which method would you select and why?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"