dolution

dolution.

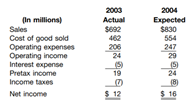

Financial statement information is presented below for Hillary Corporation, a producer of mountain climbing gear. The company expects sales to increase by about 20% in 2004.

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper NowHillary’s management is considering automating much of the company’s production process. The automation would result in about half of the company’s cost of goods sold being fixed. Currently, most of these costs vary in proportion to sales, as shown in the financial numbers presented above.

Required

A. Assume that half ($231 million) of Hillary’s cost of goods sold in 2003 is fixed and that the other half increases in proportion to sales, an increase of 20%. Compute the company’s expected cost of goods sold.

B. Using the same assumptions as part A, compute expected net income for 2004. Assume that income taxes are 35% of pretax income. Round to the nearest million.

C. Compare your results with those presented above, which assume that cost of goods sold varies in proportion to sales. What effect would the automation have on Hillary’s profitability? What effect would it have on the company’s risk? Explain your answer.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"