dolution

dolution.

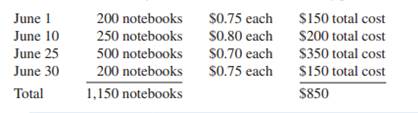

James has recently accepted a position as assistant inventory clerk at PBC Office Supplies. His main responsibilities will focus on tracking inventory costs, calculating cost of goods sold, determining turnover rates, and other aspects of ensuring good inventory control procedures. Today he wants to determine how the cost of goods sold would differ under three possible methods. He will focus on three-subject notebooks, because those are hot sellers with school starting in just a few weeks. A review of accounting records indicates the following purchases of notebooks from their suppliers: 1. At their Fourth of July Back-to-School Sale, PBC sold 700 notebooks. What is the cost of goods sold and ending inventory under the LIFO, FIFO, and weighted-average methods? 2. On occasion, James will sometimes use the gross profit method for estimating ending inventory and cost of goods sold. If PBC generally has a profit margin of 33% on the sale of notebooks and they sold $700 worth of notebooks, what is the estimated cost of goods sold and estimated ending inventory? 3. James also wants to calculate the inventory turnover rate for the entire stationery section for the last six-month period. His beginning inventory was $400,000, his ending inventory was $350,000, and net sales at cost were $800,000. What were the average inventory and turnover rate at cost?

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You wonât have to worry about the quality and deadlines

Order Paper NowÃÂ

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"