dolution

dolution.

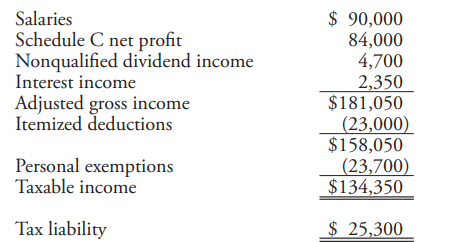

AMT. (Obj. 4) James M. (SSN 346-57-4657) and Tammy S. (SSN 465-46-3647) Livingston prepared a joint income tax return for 2014 and claimed their four children as dependents. Their regular taxable income and tax liability were computed as follows:

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You wonât have to worry about the quality and deadlines

Order Paper NowThe Livingstons received $25,000 of tax-exempt interest from specified private activity bonds purchased in 2005. In computing taxable income, the Livingstons took $7,000 depreciation on Schedule C, using the MACRS 200% declining balance method on property with a fiveyear class life. AMT allows $5,500 of depreciation for the same property. Itemized deductions include charitable contributions of $9,000, state and local property taxes of $6,712, casualty losses of $775 (after the 10% AGI floor), state income taxes of $4,513, and miscellaneous itemized deductions of $2,000 (after the 2% AGI floor). Complete Form 6251 for the Livingstons.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"