dolution

dolution.

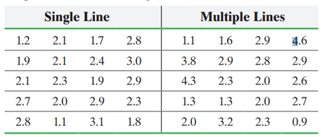

Waiting Time in Line McDonald’s executives want to experiment with redesigning its restaurants so that the customers form one line leading to four registers to place orders, rather than four lines leading to four separate registers. They redesign 30 randomly selected restaurants with the single line. In addition, they randomly select 30 restaurants with the four-line configuration to participate in the study. At each restaurant, an employee monitors the wait time (in minutes) of randomly selected patrons. The following data are collected.

(a) Is the variability in wait time in the single line less than that for the multiple lines at the ![]() Ă‚Â level of significance? Note: Normal probability plots indicate that the data are normally distributed.

Ă‚Â level of significance? Note: Normal probability plots indicate that the data are normally distributed.

(b) Draw boxplots of each data set to confirm the results of part (a) visually.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"