dolution

dolution.

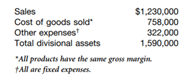

Employees of the divisions of JX Controls, Inc. receive a bonus of 4% of their salary in any year in which the divisional return on assets is above 10%. Toward the end of 2004, accountants for the fire alarm division projected the following year-end numbers:

At a meeting of divisional managers, Susan Torres, divisional vice president, told the group, “We’ve never received the bonus, although several other divisions have. Our employees work just as hard, and many of them really need the extra money for their families; I’d like us to get the bonus for them, as well as for ourselves. What ideas do you have for pulling it off?” A variety of ideas were raised:

• “Let’s do what we can about sales. We have an order for ![]() 40,000 in goods to be shipped in early January; could we get those out the door in December, and add that gross margin to this year’s numbers?”

40,000 in goods to be shipped in early January; could we get those out the door in December, and add that gross margin to this year’s numbers?”

• “Sure—good idea. We might even accidentally overship by 20% and record the extra in this year’s sales.”

• “Could we slow down a bit on paying our bills? Wouldn’t a few suppliers be willing to wait until January—maybe for about ![]() 50,000?”

50,000?”

• “We’ve got that old forming machine that hasn’t been used for a year; it’s really useless. It’s on the books at ![]() 60,000 and is 70% depreciated, but it’s worth only about

60,000 and is 70% depreciated, but it’s worth only about ![]() 3,000 as scrap. Have we written it down?”

3,000 as scrap. Have we written it down?”

• “The projection includes that new ![]() 90,000 bending machine that just came in. We should have delayed ordering it—but we haven’t booked it. Could we forget to record the machine and the payable until January?”

90,000 bending machine that just came in. We should have delayed ordering it—but we haven’t booked it. Could we forget to record the machine and the payable until January?”

Required Write a short report reacting to the meeting. Determine which proposals would both be in accordance with accounting standards and actually raise return on assets. Calculate return on assets for the current projection, and with the inclusion of those measures that meet these two tests. Also include your thoughts about the advantages and disadvantages of such a bonus system.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"