solution

solution.

Analyzing Financial Statement Effects of Intercorporate Investments

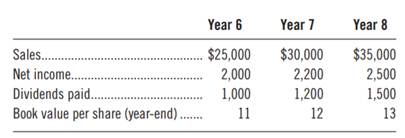

The following data are from the annual report of Francisco Company, a specialized packaging manufacturer:

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Now

Note: Francisco had 1,000 common shares outstanding during the entire period. There is no public market for Francisco shares.

Potter Company, a manufacturer of glassware, made the following acquisitions of Francisco common shares:

January 1, Year 6 Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â 10 shares at $10 per share

January 1, Year 7 Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â 290 shares at $11 per share, increasing ownership to 300 shares

January 1, Year 8 Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â Ă‚Â 700 shares at $15 per share, yielding 100% ownership of Francisco

Ignore income tax effects and the effect of lost income on funds used to make these investments.

Required:

a. Compute the effects of these investments on Potter Company’s reported sales, net income, and cash flows for each of the Years 6 and 7.

b. Calculate the carrying value of Potter Company’s investment in Francisco as of December 31, Year 6, and December 31, Year 7.

c. Discuss how Potter Company accounts for its investment in Francisco during Year 8. Describe any additional information necessary to calculate the impact of this acquisition on Potter Company’s financial statements for Year 8.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"