solution

solution.

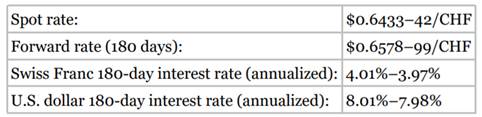

American Airlines is trying to decide how to go about hedging CHF70 million in ticket sales receivable in 180 days. Suppose it faces the following exchange and interest rates.

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper Nowa. What is the hedged value of American’s ticket sales using a forward market hedge?

b. What is the hedged value of American’s ticket sales using a money market hedge? Assume the first interest rate is the rate at which money can be borrowed and the second one the rate at which it can be lent.

c. Which hedge is less expensive?

d. Is there an arbitrage opportunity here?

e. Suppose the expected spot rate in 180 days is $0.67/CHF, with a most likely range of $0.64 to $0.70/CHF. Should American hedge? What factors should enter into its decision?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"